Institutional Algorithmic Trading Platform

Automated trading software that executes trades on your connected accounts using predefined algorithms and risk controls

You retain full control of your brokerage account at all times.

THE INSTITUTIONAL TRADING PROCESS

Enterprise-Grade Algorithmic Trading

Our proprietary algorithms follow a sophisticated institutional process that continuously analyzes global markets, identifies high-probability opportunities, and executes trades with institutional precision.

Institutional Market Analysis

Our proprietary algorithms continuously scan global markets across forex, futures, crypto, and commodities, analyzing comprehensive data sets including price action, volume, volatility, and market microstructure.

- 24/7 Global Market Surveillance

- Multi-Timeframe Institutional Analysis

- Market Microstructure Integration

- Advanced Volume & Volatility Analysis

Market Intelligence

Advanced pattern recognition and market microstructure analysis identify institutional-grade trading opportunities across multiple asset classes.

Institutional Signal Generation

Using proprietary machine learning models and institutional-grade analysis, our algorithms generate high-probability trading signals based on multiple technical indicators, market structure, and sophisticated risk management protocols.

- Proprietary Machine Learning Models

- Multi-Indicator Institutional Confirmation

- Advanced Risk-Reward Optimization

- Sophisticated Signal Filtering

Signal Intelligence

Proprietary AI models analyze market conditions and generate precise institutional-grade entry and exit signals with optimized risk-reward parameters.

Institutional Risk Management

Every trade is automatically managed with enterprise-level risk controls, including dynamic position sizing, sophisticated stop-loss placement, and comprehensive portfolio diversification to preserve capital.

- Dynamic Institutional Position Sizing

- Sophisticated Stop-Loss Management

- Comprehensive Portfolio Diversification

- Advanced Drawdown Protection

Capital Protection

Enterprise-level risk management systems ensure optimal capital preservation while maximizing institutional profit potential.

Institutional Trade Execution

Trades are executed automatically with institutional precision, ensuring optimal entry and exit prices while maintaining strict enterprise risk management protocols.

- Institutional-Grade Execution

- Optimal Entry/Exit Precision

- Real-Time Institutional Monitoring

- Advanced Performance Analytics

Execution Excellence

Institutional-grade execution ensures optimal price capture while maintaining strict enterprise risk controls and compliance protocols.

Advanced Trading Algorithms

INSTITUTIONAL-GRADE AUTOMATED TRADING SYSTEMS

Choose from our suite of proprietary algorithms engineered with cutting-edge technology and proven institutional-grade performance. Each algorithm is designed for different market conditions and trading preferences, delivering consistent results with zero emotional bias.

Hedge Fund Algo

Built for the forex market, the Hedge Fund Algo leverages institutional trading logic on major currency pairs. Advanced AI-powered algorithms adapt to trend shifts using proprietary volatility filters, liquidity zones, and sophisticated risk parameters. Ideal for consistent 24/7 execution delivering 4-12% monthly returns with zero emotional bias.

- Institutional-Grade Algorithm Technology

- Advanced AI-Powered Market Analysis

- MetaTrader 4/5 Platform Integration

- Proprietary Risk Management System

- 24/7 Expert Support Team Access

- Lifetime Software Updates Included

- Zero Emotional Trading Bias

XAU Algo

The XAU Algo is engineered specifically for trading gold (XAU/USD) during high-volatility London and New York sessions. Advanced machine learning models capture powerful breakouts and reversals with institutional-grade precision. Proprietary algorithms are laser-focused on gold's unique market microstructure, delivering consistent 6-17% monthly returns with optimized risk-reward parameters.

- Advanced Machine Learning Models

- Institutional-Grade Market Analysis

- MetaTrader 4/5 Platform Integration

- Proprietary Risk Management System

- 24/7 Expert Support Team Access

- Lifetime Software Updates Included

- Zero Emotional Trading Bias

Futures X Algo

Designed exclusively for Nasdaq Futures (NQ), the Futures X Algo targets intraday momentum with institutional-grade execution. Advanced AI filters market noise with sophisticated breakout logic, executing only 1-3 high-quality trades per day. Perfect for prop firm traders delivering consistent 8-15% monthly returns with zero emotional bias in the fast-paced futures markets.

- Proprietary Futures Trading Technology

- Advanced AI Market Noise Filtering

- NinjaTrader Platform Integration

- Institutional-Grade Risk Management

- 24/7 Expert Support Team Access

- Lifetime Software Updates Included

- Zero Emotional Trading Bias

Next-Generation

Trading Intelligence

Proprietary Algorithmic Research

Our quantitative research division has developed breakthrough trading algorithms that represent the future of institutional finance. These next-generation systems utilize advanced artificial intelligence, quantum computing principles, and proprietary market microstructure analysis to achieve unprecedented performance metrics across global markets. Currently in final validation phase with select institutional partners.

CRYPTO X

ALGO

Advanced Cryptocurrency Trading

- Proprietary quantum-inspired algorithms for cryptocurrency market prediction

- Real-time blockchain analytics with institutional-grade execution infrastructure

- Multi-dimensional strategy matrix: 12 concurrent ML models across BTC, ETH, and emerging altcoins

- Native integration with Binance, Coinbase Pro, Kraken, and 15+ tier-1 exchanges

- Advanced on-chain analysis incorporating whale movement patterns and DeFi yield farming

- Institutional risk management with dynamic position sizing and volatility-adjusted exposure

INSTITUTIONAL

ALGO

Enterprise-Grade Trading System

- Hedge fund-grade systematic trading with dedicated institutional relationship management

- Comprehensive onboarding with quantitative analyst support and performance attribution analysis

- Multi-asset capital allocation across 50+ systematic strategies spanning FX, commodities, equities, and fixed income

- Prime brokerage integration with Goldman Sachs, Morgan Stanley, and institutional ECN networks

- Advanced portfolio construction using Black-Litterman optimization and risk parity methodologies

- White-glove institutional service with dedicated trader, risk manager, and 24/7 institutional desk support

MARKET MAKER

ALGO

Liquidity Provision Strategy

- Institutional-grade market making with microsecond latency execution and co-location infrastructure

- Advanced microstructure training including order flow toxicity analysis and adverse selection modeling

- Proprietary alpha generation through predictive bid-ask optimization and inventory risk management

- Direct market access integration with NYSE, NASDAQ, CME, and 40+ global electronic trading venues

- Real-time volatility surface modeling with dynamic spread adjustment and optimal skew positioning

- Sophisticated inventory management using stochastic optimal control and regime-switching hedging models

Early Access Program

Be among the first to experience our next-generation trading algorithms. Early access members receive priority notifications, exclusive previews, and special launch pricing. Join our elite community of forward-thinking traders and institutional partners.

Everything You Need to Know About Market Master

Get answers to the most common questions about our automated trading algorithms and institutional-grade platform.

Still Have Questions?

Our team of trading experts is here to help you understand how Market Master can transform your trading strategy.

Contact Our TeamReal Investors. Real Results.

We track every client account live with platforms like MyFXBook and FX Blue. Join hundreds of investors across 71+ countries seeing algorithm-driven consistency.

EXPERIENCE BEST YOUR COMPANY PROPERTIES

View Featured Projects

Furnished Villas

Your company SmartHome

Your Company Resort

Home Apartments

Enjoyable Amenities

Boluptate velit cillum dolore fugiat nulla pariatur. Excepteur anim idet laborum. Sed ut perspiciatis und omnis iste natus sit holuptatem accusantium sed laudantium.

Dryer & Washer

En-Suite Bathroom

King Size Beds

Package Services

Sports & Golf Hall

Grand Library

INTEGRATED REAL ESTATE GROUP

Powered By Builders Loved By People

INTEGRATED REAL ESTATE GROUP

Industry Leader In Property Development

Constructing Since 1995, For Lasting & Positive Relations

Koluptate velit cillum dolre fugiat nula pariatur. Excepteur anim idet laborum. Sed ut perspiciatis und omnis iste natus goluptatem acusantium dolore mque lorem ipsum dolor sit amet consectetur adipisicing elit sed incididunt.

Floor Planning

Architecture Design

Landscape Design

Trading Terminologies & Abbreviations with Examples

Let’s learn some important forex trading terminologies and abbreviations. We will always update this page. So you can bookmark it for the next visits.

BOS (Break of structure)

When price breaks a low or high then it is called BOS or break of structure.

dBOS (Double break of structure)

When price breaks two lows or highs respectively then it is called dBOS or double break of structure.

mBOS (Minor break of structure)

When price breaks lows or highs in the lower timeframes then it is called mBOS or minor break of structure.

OB (Order block)

OB or order block is the last opposing one or multiple close candles before a strong directional move. The last sell Candle before the bullish impulse move is called bullish order block and the last buy candle before the bearish impulse move is called bearish order block.

AOI (Area of interest)

These are the areas where we expect the price will react and has the possibility to reverse direction.

POI (Point of interest)

It is also called DP or decision point.

IMB (Imbalance)

Imbalance is an area of unequal market moves where there are only buyers or only sellers exist in the market. It is inefficient or unhealthy price action. It shows disequilibrium between Buyers/Sellers. So an imbalance means unfair price action where the market will almost always come back to fill. Here, the wicks do not fill each other (If they do then it is healthy price action and not an imbalance). It is not mitigation. So, the price doesn’t have to reverse from that point).

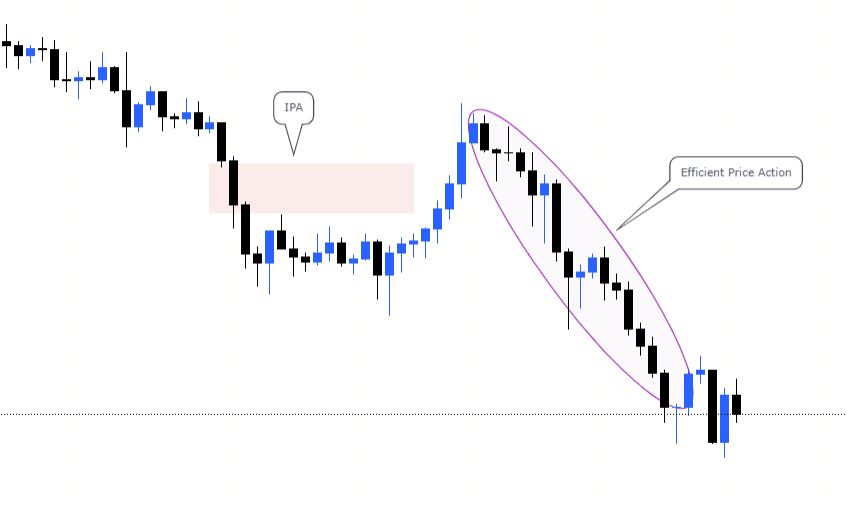

imbalance in forex trading chart

EQ (Equilibrium)

It means fair market value or 50%.

INF (Inefficiency)

It indicates the lack of buyers or sellers in price action, leaving disequilibrium that eventually needs to be filled. If there’s a gap with a large candle that’s the inefficiency of price.

LQ (Liquidity)

Liquidity simply means money or huge opposite orders to be filled to fuel the movement of the market institutions.

IPA (Inefficient price action)

Inefficient price action or imbalance(Lack of Buyers/Sellers in price action, leaving disequilibrium that eventually needs to be filled)

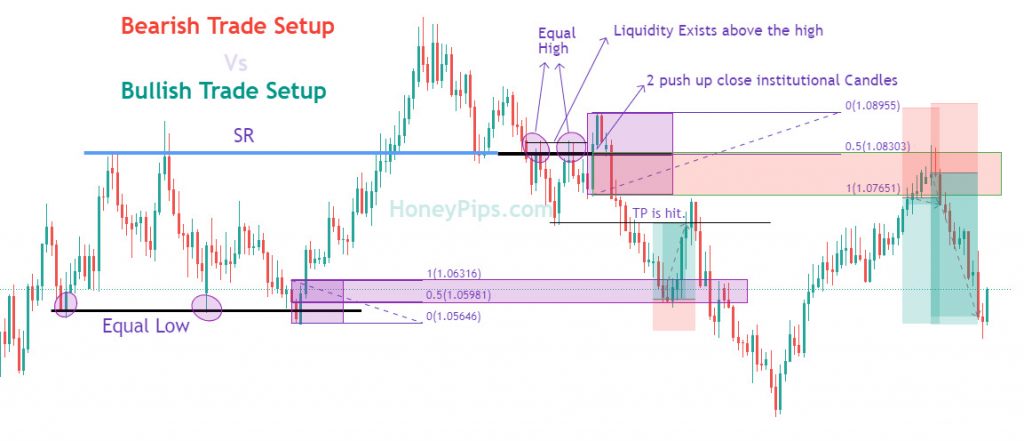

EQL (Equal lows)

It simply means the liquidity below the double bottom (DB).

EQH (Equal highs)

It means the liquidity above the double top (DT).

IT (Institutional Trading)

There are several ways to identify institutional trading. These are:

SHC (Stop Hunt Candle)

Fake-out

OB (Order Block)

Large Volume Range

Imbalances (Lack of Buyers/Sellers in price action, leaving disequilibrium that eventually needs to be filled)

WKF (Wyckoff)

WAS – Wyckoff Accumulation Schematic

WDS – Wyckoff Distribution Schematic

ST – Secondary Test

SOS – Sign of Strength

SOW – Sign of Weakness

LPS – Last Point of Support

LPSY – Last Point of Supply

UT – Upthrust

UTAD – Upthrust After Distribution

SC – Selling Climax

BC – Buying Climax

AR – Automatic Rally Reaction)

TR – Trading Range

PS – Preliminary Support

PSY – Preliminary Supply

Other Abbreviations

BFI – Banks & Financial Institutions

PA – Price action

HH – Higher High

HL – Higher Low

LH – Lower High

LL – Lower Low

Fib – Fibonacci

TF – TF

LTF – Lower time frames

HTF – Higher time frames

MN – Monthly

W – Weekly

D – Daily

H4 – 4 hours

H1 – 1 hour

M15 – 15 minutes

M1 – 1 minute

MS – Market Structure

MOM – Momentum

HTF – Higher Time Frame

LTF – Lower Time Frame

R = Reward/percentage

RSP – Real Structure Point

PRZ – Price Reversal Zone

CPB – Complex Pullback

M – Momentum

RR – Risk: Reward

TGT – Target

SL – Stop Loss

BE – Breakeven

BSL – Buy-side liquidity

SSL – Sell-side liquidity

SC – Sponsored candle

IFC – Institutionally funded candle

EOF – Expectational order flow

Liq – Liquidity

SMC – Smart Money Concepts

SB – Sub break of structure

DD – Drawdown

Be – Bearish

Bu – Bullish

HNS – Head and Shoulders

IT – Institutional Traders

CO – Composite Operators

WHB – Weak Handed Buyers

WHS – Weak Handed Sellers

SHC – Stop Hunt Candle

OBIM – Order Block with Imbalance

OBOB – Lower timeframe Order Block within a higher timeframe Order Block

TR – Trading Range

IT – Institutional Traders

CO – Composite Operators

LP – Liquidity Providers